What is an e-commerce payment gateway?

In this content, you’ll discover how payment gateways operate, the top choices available, their advantages, security features, and the often-overlooked challenges businesses face.

E-commerce is booming. Millions of transactions happen every second.

But none of it would work without one crucial system keeping everything running smoothly. What is an e-commerce payment gateway?

E-commerce payment gateway is the invisible engine behind every online purchase. This payment system also ensures money moves securely from buyers to sellers. Without it, your checkout button is just decoration.

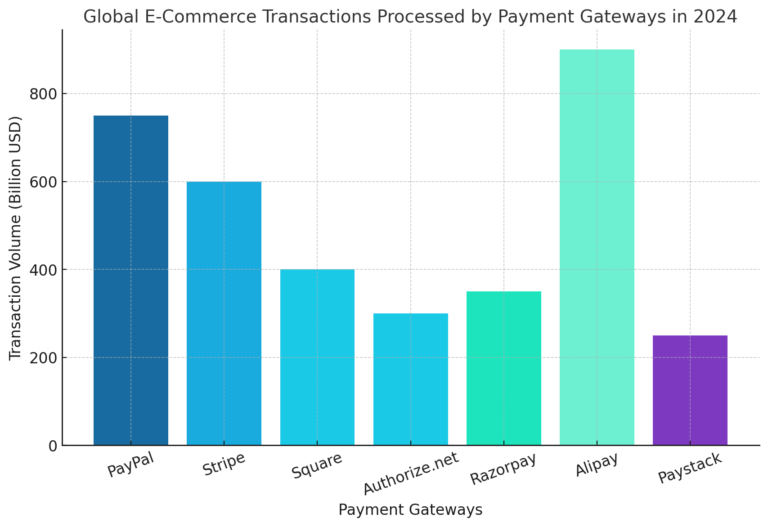

Here you can see a bar chart showing the global e-commerce transactions processed by major payment gateways in 2024. Think of it as a digital bouncer. It verifies payments, encrypted sensitive data, and keeps fraudsters out.

No gateway? No sales. No business.

If you’re selling online, choosing the right one isn’t optional. It’s survival.

In this content, you will learn how payment gateways work, the best options available, their benefits, security measures, and even some hidden drawbacks that most businesses overlook.

What Exactly Is an E-Commerce Payment Gateway?

Every online transaction needs a middleman. That’s the e-commerce payment gateway. It acts as a digital bridge, securely transferring money from the buyer to the seller. No gateway, no transaction.

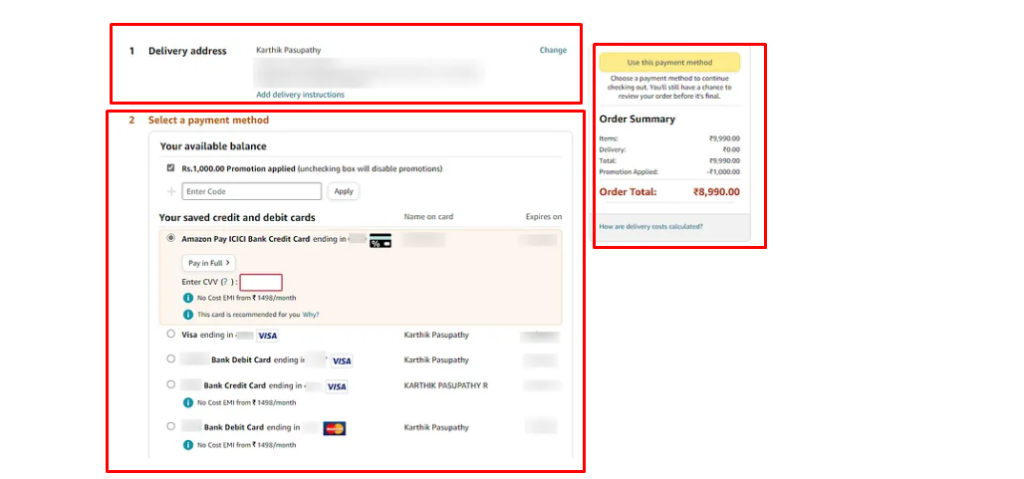

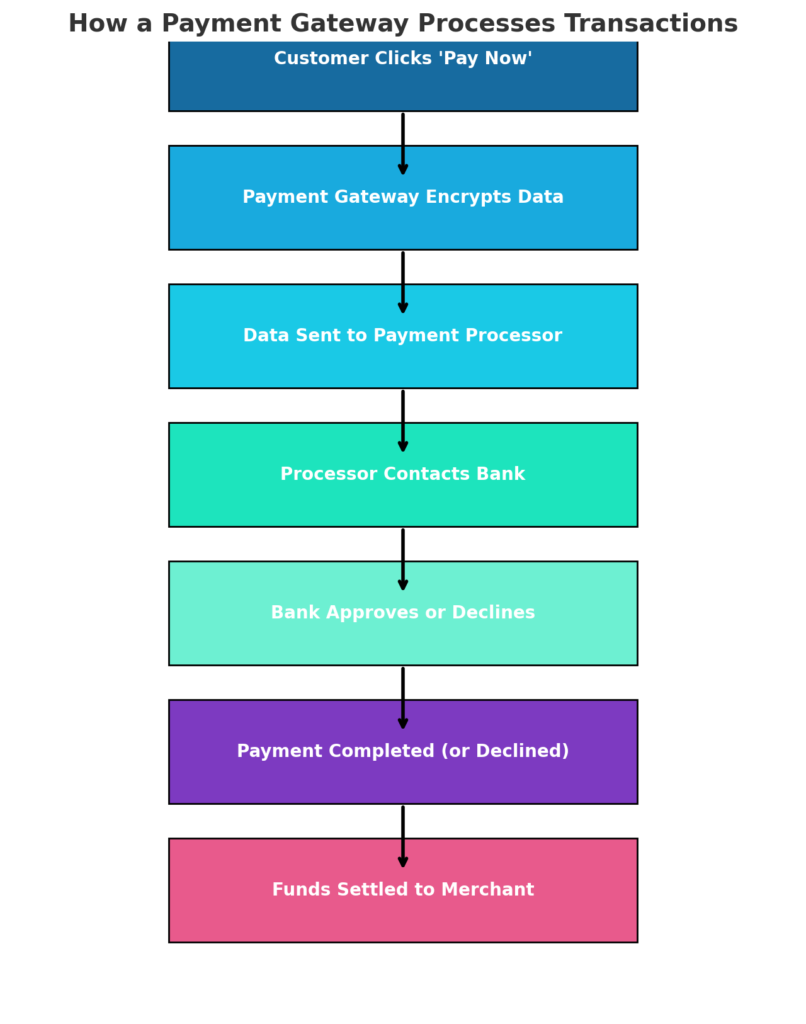

When a customer clicks “Pay Now,” the gateway jumps into action. It encrypts sensitive payment details and sends them to the payment processor.

The processor checks with the customer’s bank or card provider. If everything looks good, the payment is approved in seconds. If not, the transaction is declined, and the customer is left wondering why their card betrayed them.

Security is the biggest job here.

These gateways use TLS encryption, PCI DSS compliance, and AI-driven fraud detection to keep payments safe.

In 2023, global fraud losses from online transactions hit $48 billion. A strong payment gateway helps prevent that.

Gateways also enable multiple payment methods. Credit cards, digital wallets, even cryptocurrencies. This is giving customers options to increase conversions. Studies show that businesses offering three or more payment methods see up to 30% higher sales.

Without a payment gateway, e-commerce would be chaos. Customers couldn’t pay, businesses wouldn’t get money, and online shopping would collapse.

How Does an E-Commerce Payment Gateway Work?

A payment gateway is the silent workhorse of online shopping.

First, it encrypts the payment details. Credit card numbers, CVVs, and personal data get locked behind strong encryption. This prevents hackers from stealing sensitive information.

Next, the data rushes to the payment processor.

The processor checks with the customer’s bank or card provider. If the bank approves, the payment is processed instantly. If not, the transaction is declined, and the cart stays abandoned.

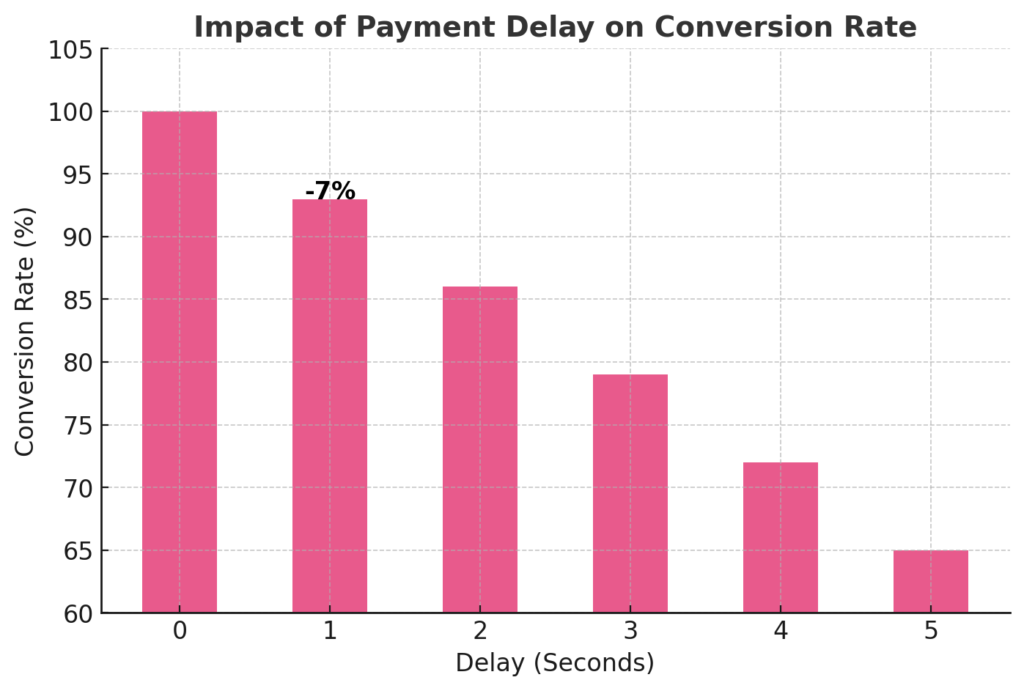

This all happens in seconds. A delay of even one second can drop conversions by 7%. Speed matters.

Security is a top priority.

Every transaction passes through fraud detection systems. AI-powered tools analyze patterns, flag suspicious activity, and block potential fraud.

In 2023, online fraud caused $48 billion in losses. Gateways help businesses fight back. Payment gateways also ensure businesses get their money. Once approved, funds are settled into the merchant’s account.

The process takes anywhere from a few minutes to a couple of days, depending on the gateway and bank policies.

Without a payment gateway, online sales would be chaotic.

Customers wouldn’t trust transactions. Businesses wouldn’t get paid. And e-commerce as we know it wouldn’t exist.

Which Types of Payment Gateways Are Available?

Not all payment gateways are built the same.

Some are easy, some are complex, and some can drive you crazy if not set up right. Choosing the right one can mean the difference between seamless transactions and frustrated customers hitting the exit button.

Hosted Payment Gateways.

These are the plug-and-play option.

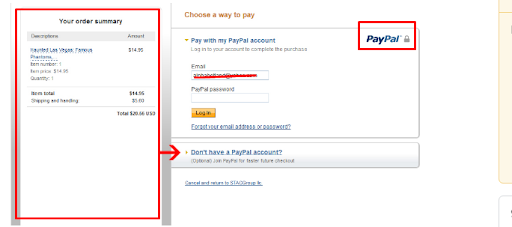

Providers like PayPal, Stripe, and Razorpay handle transactions on their platforms. When a customer pays, they’re redirected to the gateway’s site to complete the process. It’s secure, easy, and requires little technical knowledge.

But there’s a catch.

Redirecting users adds friction, which can hurt conversion rates. Studies show that an extra step in checkout can reduce conversions by 10-20%.

If branding and user experience matter, this option might not be the best.

Self-Hosted Payment Gateways

Here, the payment process happens on your site, but the actual transaction is handled in the background by the gateway.

This gives more control over branding and user experience. WooCommerce Payments and Shopify Payments are popular choices.

Security is a concern.

Since transactions occur on your site, you must ensure PCI DSS compliance. A single vulnerability can expose customer data, leading to fines and reputation damage.

API-Based Payment Gateways

For those who love customization, API-based gateways are perfect.

These integrate directly into your site, creating a seamless checkout experience. Stripe and Authorize.net are top players in this space.

This approach needs developer expertise. If not set up properly, issues like failed transactions and security risks can arise. But if done right, it provides a fast and professional payment experience.

A smooth API integration can increase conversion rates by 35%, according to Stripe’s internal data. Customers stay on your site, transactions feel effortless, and trust builds.

Local Bank Payment Gateways

For businesses catering to a specific country or region, local bank payment gateways are a reliable choice.

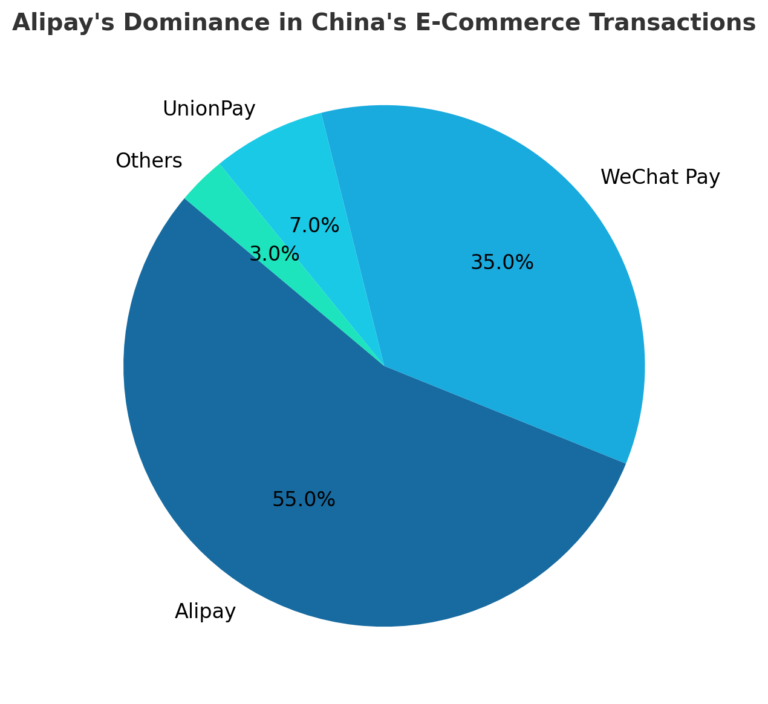

Alipay (China), Paystack (Africa), and PayU (India & Latin America) dominate their markets. These gateways are trusted by local customers. Thus, it makes payments feel safer. However, they often lack global reach. If you want to scale internationally, you’ll need additional payment options.

Why Choosing the Right Gateway Matters

Picking the wrong gateway can kill sales. A slow or complicated checkout process causes 69% of cart abandonments. Customers expect security, speed, and flexibility.

A good gateway improves trust. If people see familiar payment options, they’re more likely to complete their purchase. 75% of online shoppers prefer to use a gateway they recognize.

Offering multiple payment options also helps. Businesses that provide at least three payment methods see a 30% increase in conversions. Diversity in payment options attracts global customers and reduces drop-offs.

Which One Should You Choose?

It depends on your business needs.

- If you want a fast and secure setup: Go for hosted gateways like PayPal or Stripe.

- If branding matters: Use self-hosted gateways like Shopify Payments.

- For full control: Choose an API-based gateway like Authorize.net.

- For regional sales: Use a local bank gateway like PayU or Alipay.

The right gateway boosts sales, improves customer experience, and strengthens security. The wrong one? It slows everything down, causes abandoned carts, and leads to lost revenue.

Which Payment Gateway Is Best for E-Commerce?

Not all payment gateways are equal. Some work like a charm. Others might give you headaches. Choosing the right one can make or break your online business.

Some offer top-tier fraud protection. And some dominate specific regions. Here’s a breakdown of the top choices.

1. PayPal – The Household Name

PayPal is everywhere. Over 400 million active users trust it. It’s beginner-friendly, easy to integrate, and widely accepted.

The downside? Fees. Transaction fees can go up to 4.4% per sale, which is high for businesses with thin margins. But if you want a reliable, well-known option, PayPal delivers.

2. Stripe – Developer’s Favorite

Stripe is the king of customization. It allows businesses to create a seamless, API-driven checkout experience. It’s used by brands like Amazon and Shopify.

Stripe supports 135+ currencies and multiple payment methods, including Apple Pay and Google Pay. If you’re tech-savvy and want a fully branded checkout, Stripe is a top pick.

One challenge? It requires technical expertise. If you’re not comfortable with coding, setup can be tricky.

3. Square – Perfect for Small Businesses

Square is great for both online and offline sales. It’s a go-to choice for small businesses, especially those that also sell in physical stores.

It offers flat-rate pricing and an easy setup. But it’s not the best for global transactions. If your business operates worldwide, better options exist.

4. Authorize.net – The Old but Gold Choice

Authorize.net has been around since 1996. It’s not flashy, but it gets the job done. It supports credit cards, PayPal, Apple Pay, and eChecks.

Fraud prevention is a big plus. It offers Advanced Fraud Detection, reducing the risk of chargebacks. However, monthly fees and complex setup might be a dealbreaker for small businesses.

5. Razorpay – India’s Top Payment Gateway

For businesses in India, Razorpay is a game-changer. It supports UPI, credit cards, wallets, and even EMI payments.

It offers low transaction fees and easy integration with platforms like WooCommerce and Shopify. But for businesses outside India, it’s not the best choice.

6. Alipay – The Giant in China

Alipay dominates China’s online payments. It has over 1.3 billion users. If you want to sell in China, this is the must-have payment gateway.

The downside? It’s mainly for Chinese customers. If your audience isn’t in China, it’s not worth integrating.

7. Paystack – Africa’s Rising Star

Paystack is the Stripe of Africa. It makes payments seamless for businesses operating in Nigeria, Ghana, Kenya, and South Africa.

It’s backed by Stripe and offers an easy integration process. If you’re expanding into Africa, this is the best payment solution.

How Do You Pick the Right One?

Your choice depends on three things:

- Where You Sell – If your audience is in China, go with Alipay. In India? Razorpay is the best fit.

- Your Technical Ability – Stripe is great if you have coding skills. If not, PayPal or Square is easier.

- Transaction Fees – High-volume businesses should avoid gateways with high per-sale fees like PayPal.

How Secure Are E-Commerce Payment Gateways?

Security isn’t optional in online transactions. It’s the foundation of trust between buyers and sellers. A weak payment gateway is like leaving your shop door open with a neon sign that says, “Steal from me.”

Cybercriminals are getting smarter. In 2023 alone, global e-commerce fraud losses hit $48 billion. Without strong security measures, businesses lose money, and customers lose trust.

1. Encryption Protects Sensitive Data

The moment a customer enters their payment details, the gateway encrypts the information. It converts card numbers and CVVs into unreadable codes. Even if hackers intercept the data, they can’t use it.

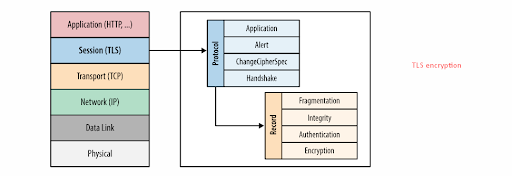

Most gateways use TLS (Transport Layer Security) and SSL (Secure Sockets Layer) encryption. These protocols make sure sensitive information stays private.

If a payment gateway doesn’t use encryption, run the other way.

2. Fraud Detection Blocks Suspicious Transactions

Modern payment gateways use AI-driven fraud detection systems. These tools analyze transaction patterns, flag suspicious activity, and block unauthorized payments.

For example, if someone suddenly tries to buy 50 iPhones from an unusual location, the gateway pauses the transaction. It checks for red flags like IP mismatches, card inconsistencies, and unusual spending patterns.

Fraud prevention tools save businesses billions every year. Stripe Radar, for example, claims to reduce fraud rates by 89% using AI-powered risk assessments.

To detect the fraud, you can calculate something which can help you to detect. You can use “Fraud Risk Checker”.

Fraud Risk Checker

What Are the Biggest Security Threats?

Even the most secure payment gateway can’t stop 100% of fraud. Here are the biggest threats businesses face:

1. Phishing Attacks

Hackers send fake emails pretending to be from a payment gateway. If a merchant clicks a malicious link, hackers steal login credentials and access sensitive payment data.

A study found that 22% of data breaches in 2023 were caused by phishing attacks. Merchants must always verify emails before clicking links.

2. Card Testing Fraud

Fraudsters use bots to test stolen credit card numbers on e-commerce sites. If a card works, they use it for bigger purchases elsewhere.

This is why payment gateways include CAPTCHAs and velocity checks to detect rapid, small transactions from the same card.

3. Chargeback Fraud

Some buyers exploit refund policies. They buy a product, claim they never received it, and demand a chargeback. The merchant loses both the product and the money.

In 2023, chargeback fraud cost businesses over $40 billion globally. Payment gateways now track high-risk buyers to prevent abuse.

How to Choose a Secure Payment Gateway

Not all gateways offer the same level of security. Here’s what to check before choosing one:

- PCI DSS Certification – If it’s not compliant, avoid it.

- Fraud Prevention Tools – AI-driven fraud detection is a must.

- Data Encryption – End-to-end encryption protects cardholder data.

- Multi-Factor Authentication (MFA) – Extra login security prevents account takeovers.

- Chargeback Protection – Some gateways offer insurance against fraudulent refunds.

PayPal, Stripe, and Authorize.net rank among the most secure payment gateways due to their advanced fraud detection and encryption protocols.

What Are the Challenges of Using an E-Commerce Payment Gateway?

A payment gateway is essential for online businesses.

It processes payments, secures transactions, and helps customers checkout smoothly. But it’s not all sunshine and sales.

There are challenges. Among them, some are annoying, some expensive, and some downright frustrating. Ignoring these can lead to lost sales, angry customers, and security nightmares.

1. Transaction Fees Eat into Profits

Payment gateways aren’t free. Every sale comes with a cost.

Most gateways charge 2.5% to 4.5% per transaction, depending on the provider and country. Some even add flat fees, currency conversion charges, and withdrawal fees.

For small businesses, this adds up fast. A company making $50,000 per month in online sales could lose over $1,500 monthly in gateway fees alone.

[Visual suggestion: A bar graph comparing transaction fees of PayPal, Stripe, and Square]

To reduce costs, businesses often:

- Negotiate lower rates with high sales volume

- Use local payment gateways with lower fees

- Encourage direct bank transfers for large transactions

But in most cases, transaction fees are unavoidable.

2. Chargebacks and Fraud Drain Revenue

Chargebacks are when customers dispute a transaction and get their money back. Sometimes, it’s legitimate. Other times, it’s fraud.

In 2023, chargeback fraud cost businesses over $40 billion. Some customers intentionally claim a refund after receiving the product, leaving merchants at a loss.

Payment gateways help with fraud detection, but they can’t eliminate chargebacks. Businesses must track disputes, provide proof of delivery, and respond quickly to claims.

3. Security Risks Are Always There

Payment gateways are prime targets for hackers. If they find a vulnerability, they can steal customer payment data, causing major damage.

Even the best gateways aren’t invincible. In 2023, several online retailers suffered data breaches despite using PCI DSS-compliant gateways.

To reduce risk, businesses should:

- Use MFA (Multi-Factor Authentication) for gateway access

- Regularly update software and security patches

- Train employees to recognize phishing scams

4. Technical Integration Can Be a Nightmare

Some payment gateways are plug-and-play. Others require API integration, coding, and testing before they work smoothly.

If a business lacks developer skills, integration can cause checkout errors, failed transactions, and customer frustration.

Stripe and Authorize.net, for example, offer highly customizable APIs, but they require programming knowledge. On the other hand, PayPal and Square are easier to set up but may not offer deep customization.

Testing is critical. A slow or broken checkout can lead to cart abandonment rates of over 70%.

5. Multi-Currency and Cross-Border Issues

Selling globally? Payment gateways can complicate things.

Not all gateways support all currencies. Some charge high foreign exchange fees. Others block certain transactions based on location.

A customer trying to pay in Indian Rupees or Brazilian Reais might get declined if the gateway doesn’t support it.

This creates frustration and lost sales. Businesses selling internationally should choose a gateway with multi-currency support, like Stripe or PayPal.

6. Downtime Can Kill Sales

Even the best payment gateways sometimes go offline. When that happens, customers can’t complete purchases.

A 30-minute outage during peak shopping hours can cause thousands in lost revenue.

In July 2023, major payment providers experienced a system failure, causing mass transaction declines worldwide. Businesses relying on a single gateway suffered the most.

To avoid this:

- Use multiple payment gateways as a backup

- Monitor transaction failures and switch to alternatives when needed

Future of Payment Gateways

Payment gateways are getting smarter, faster, and more secure. AI-driven fraud detection is evolving, with tools like Stripe Radar reducing fraud by 89% through real-time pattern analysis.

Cryptocurrency payments are surging. PayPal and BitPay have already integrated Bitcoin and Ethereum. By 2027, crypto adoption in e-commerce is set to grow by 250%. Biometric authentication is replacing passwords. Apple Pay and Google Pay already use fingerprint and facial recognition. Studies show that 72% of users prefer biometrics over traditional logins.

Instant payments are the new normal.

Platforms like FedNow, UPI, and RazorpayX are eliminating the 2-3 day wait for transactions. Faster payments mean better cash flow for businesses. Buy Now, Pay Later (BNPL) is exploding. It boosts conversions by 30% and is projected to hit $1 trillion by 2026. More businesses are integrating BNPL options at checkout to increase sales.

Voice commerce is on the rise.

Alexa and Google Assistant are enabling hands-free shopping. Payment gateways must now adapt to AI, crypto, biometrics, and real-time transactions. Businesses that embrace these changes will boost sales and stay ahead. Those that don’t will lose customers to faster, smoother checkout experiences.

The payment revolution isn’t coming. It’s already here.

Frequently Asked Questions(FAQs)

Is PayPal a payment gateway or processor?

Both. PayPal acts as a payment gateway and a processor, making it a one-stop solution.

Can I use multiple payment gateways?

Yes. Many businesses integrate more than one gateway to give customers multiple options.

How long does a payment gateway take to process a transaction?

Typically a few seconds, but bank processing times may cause delays.

Are payment gateways expensive?

Costs vary. Some charge a flat rate, while others take a percentage per transaction.

Do payment gateways support cryptocurrency?

Some do, like BitPay, while traditional ones are still catching up.

Final Words

An e-commerce payment gateway is not optional. It’s essential.

This gateway secures transactions, speeds up payments, and keeps businesses running smoothly. The right gateway can boost conversions, reduce fraud, and expand global reach. But the wrong one? That can cost you customers and profits.

With security getting tighter and technology advancing, payment gateways will only get better. If you’re serious about selling online, choosing the right gateway is as important as the product you sell.